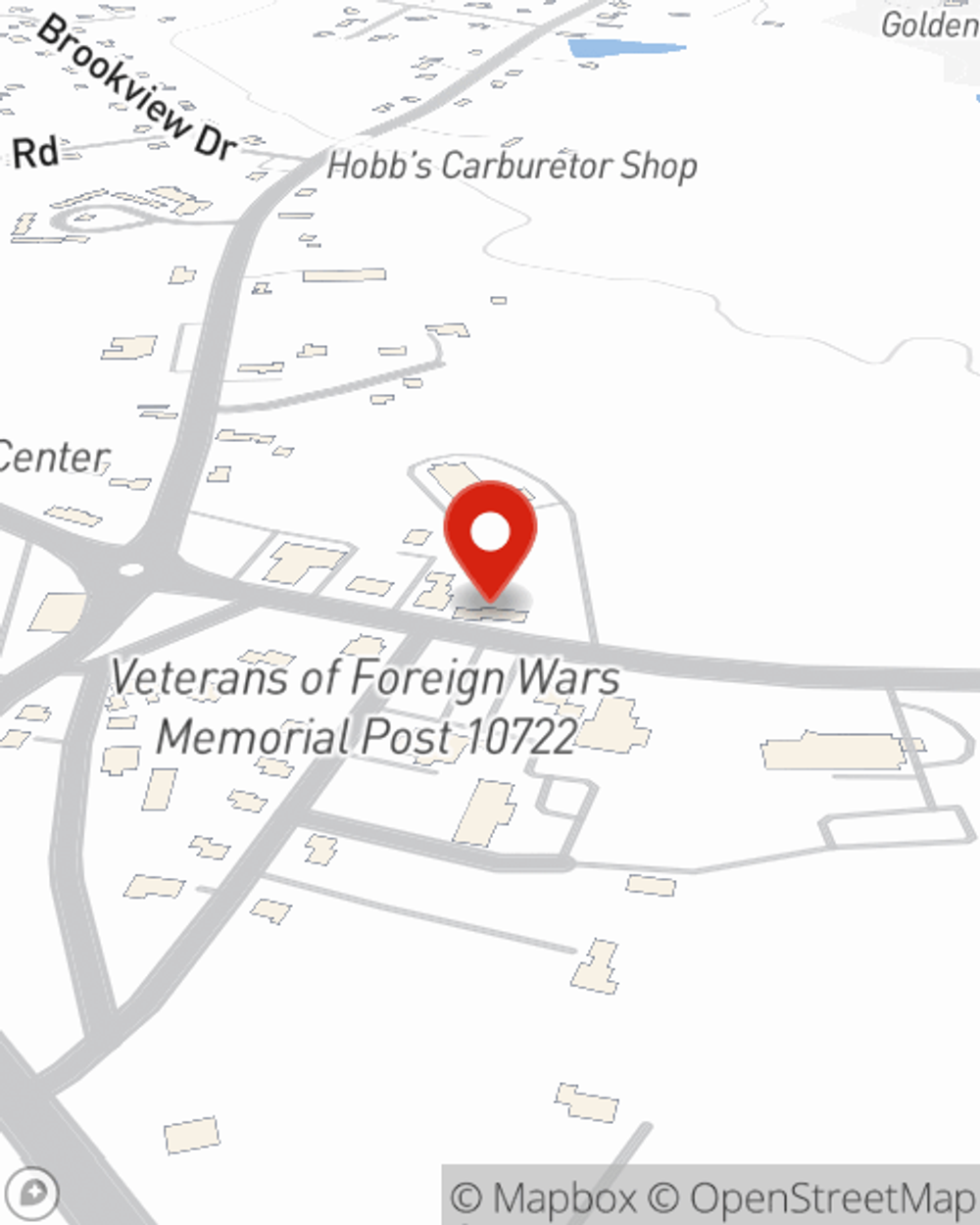

Insurance in and around Pelham

Protect the life you've built

Insurance that works for you

Would you like to create a personalized quote?

- Windham, NH

- Pelham, NH

- Hudson, NH

- Nashua, NH

- Rockingham County

- Hillsborough County

- Salem, NH

- Litchfield, NH

- Manchester, NH

- Londonderry, NH

- Derry, NH

Let Us Help You Create A Personal Price Plan®

Everyone loves saving money. Create a coverage plan that helps protect what’s important to you – family, things and your bottom line. From safe driving rewards, bundling options and discounts*, you can create a solution that’s right for you. Contact Patrick Shea for a Personalized Price Plan.

Protect the life you've built

Insurance that works for you

Protect Your Family, Vehicles, Home, And Future

With outstanding coverage options, competitive prices and great claims service, State Farm is here for you. It's what good neighbors do.

Simple Insights®

What to do if you win the lottery

What to do if you win the lottery

If you win the lottery, learn from financial professionals (and former winners) about what to do before turning in that winning ticket.

Tips on what to do if your car breaks down

Tips on what to do if your car breaks down

Learn how to safely handle an unexpected vehicle breakdown and signal your situation to other drivers.

Patrick Shea

State Farm® Insurance AgentSimple Insights®

What to do if you win the lottery

What to do if you win the lottery

If you win the lottery, learn from financial professionals (and former winners) about what to do before turning in that winning ticket.

Tips on what to do if your car breaks down

Tips on what to do if your car breaks down

Learn how to safely handle an unexpected vehicle breakdown and signal your situation to other drivers.