Renters Insurance in and around Pelham

Welcome, home & apartment renters of Pelham!

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

- Windham, NH

- Pelham, NH

- Hudson, NH

- Nashua, NH

- Rockingham County

- Hillsborough County

- Salem, NH

- Litchfield, NH

- Manchester, NH

- Londonderry, NH

- Derry, NH

Protecting What You Own In Your Rental Home

Trying to sift through coverage options and deductibles on top of your pickleball league, managing your side business and work, can be time consuming. But your belongings in your rented apartment may need the impressive coverage that State Farm provides. So when the unexpected happens, your furniture, swing sets and electronics have protection.

Welcome, home & apartment renters of Pelham!

Your belongings say p-lease and thank you to renters insurance

Agent Patrick Shea, At Your Service

Renters often raise the question: Is renters insurance really necessary? Imagine for a minute the cost of replacing your stuff, or even just one high-cost item. With a State Farm renters policy in your pocket, you won't waste time worrying about fires or break-ins. Renters insurance doesn't stop there! It extends beyond your rental space, covering personal items you've placed in a storage closet, on your deck, or inside your car. Renters insurance can even cover your identity. With so much of your life accessible online, it’s important to keep your personal information safe. That's where coverage from State Farm makes a difference. State Farm agent Patrick Shea can help you add identity theft coverage with monitoring alerts and providing support.

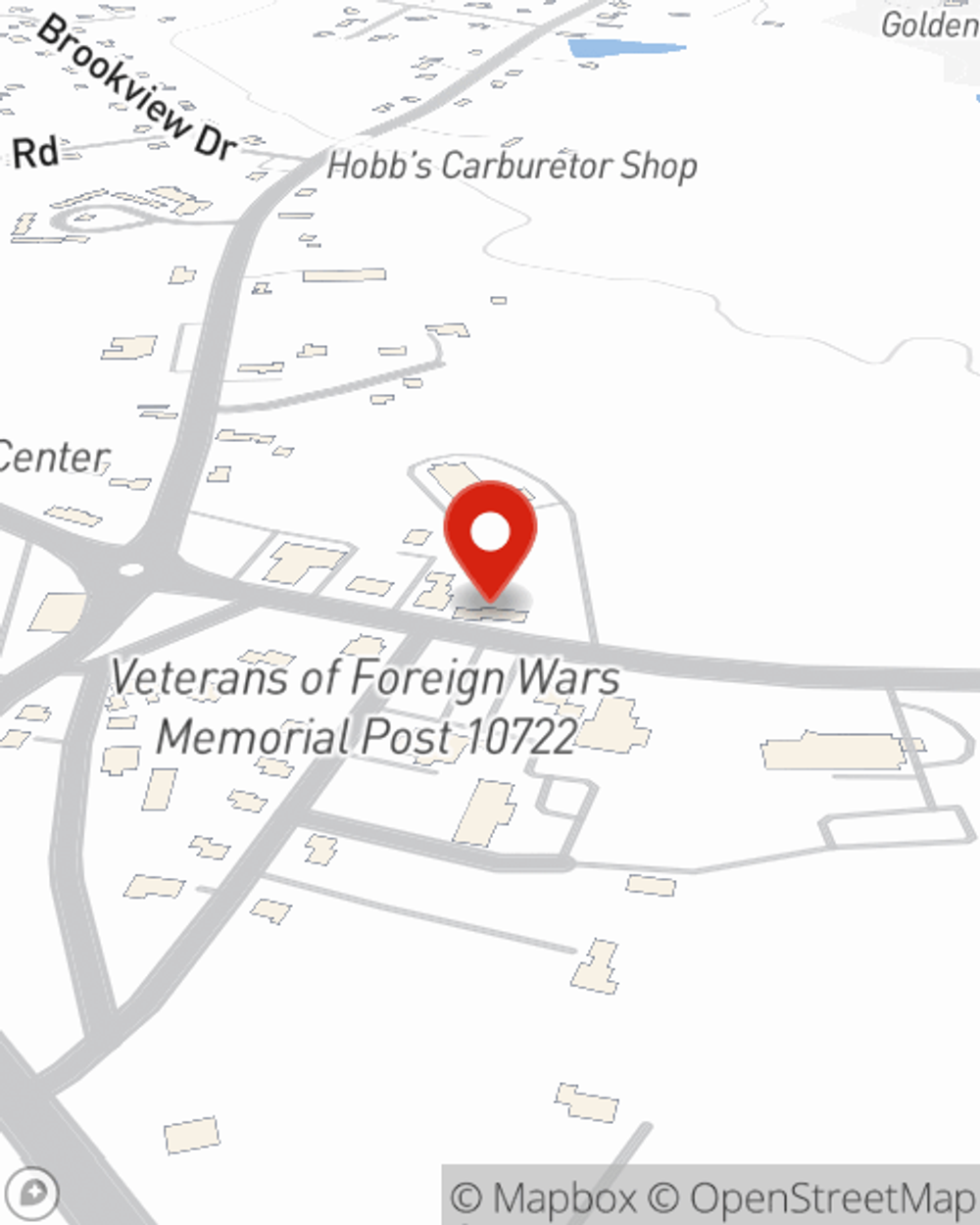

As a value-driven provider of renters insurance in Pelham, NH, State Farm is committed to keeping your valuables protected. Call State Farm agent Patrick Shea today for help with all your renters insurance needs.

Have More Questions About Renters Insurance?

Call Patrick at (603) 635-4862 or visit our FAQ page.

Simple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Patrick Shea

State Farm® Insurance AgentSimple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.